Markets struggle as inflation worries offset recovery hopes

News24

22 Feb 2021, 15:12 GMT+10

- Markets mostly fell Monday as growing worries about high valuations and inflation overshadows falling Covid-19 infection rates.

- Expectations that President Joe Biden's vast stimulus will be passed next month are also keeping spirits up, as a raft of data last week indicated the financial hit to the United States and Europe might not be as bad as feared.

- The rally that has characterised the past few months appears to have come to a halt as traders worry that prices may have become a little too frothy.

Markets mostly fell Monday as falling infection rates and more good news on the vaccine front were overshadowed by growing worries about high valuations and inflation.

While the United States is approaching 500 000 deaths, there is optimism that there is light at the end of the tunnel in the Covid-19 crisis as governments embark on immunisation programmes that will allow economies to reopen.

Expectations that President Joe Biden's vast stimulus will be passed next month are also keeping spirits up, as a raft of data last week on factory and services activity indicated the financial hit to the United States and Europe might not be as bad as feared.

News that the Pfizer/BioNTech jab appeared to prevent nine in 10 people from getting the disease in Israel - which is the most advanced in its rollout - provided a positive background. Israeli officials also said the shot was 99 percent effective at preventing deaths from the disease.

Meanwhile, hopes for a wider distribution were given a lift after Pfizer said its drug could be stored in normal medical freezers instead of the ultra-cold conditions initially thought necessary.

Shanghai and Hong Kong led losses, shedding more than one percent as the Chinese central bank sucked cash out of financial markets to ease bubble concerns. Sydney, Seoul, Wellington, Manila, Mumbai and Bangkok also fell, though there were gains in Tokyo, Singapore, Taipei and Jakarta.

London, Paris and Frankfurt all fell at the open.

The rally that has characterised the past few months looks to have come to a halt as traders fret that prices may have become a little too frothy.

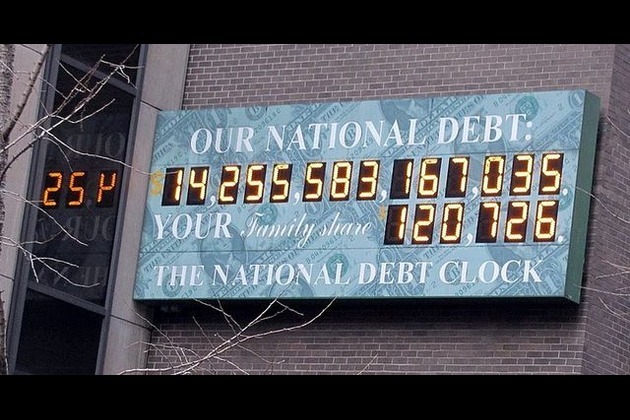

There is growing concern that the expected recovery and Biden's spending package will fire a surge in inflation, which could force the Federal Reserve to wind back the loose monetary policies and record-low interest rates that have been a key pillar of a near-year-long market surge.

Sterling holds dollar gains

"The Biden administration continues to stay on message stressing Congress's need to pass a significant fiscal package, downplaying recent more robust economic data as... a package exceeding $1.9 trillion heads for a House vote this week," said Axi strategist Stephen Innes.

"The unprecedented and highly stimulatory policy is an attempt to exceed one million jobs a month from April to September.

"But timing is everything. The next leg of the reflation will have to be carried more and more by a continued recovery in economic growth... and all the while this will bring the Fed closer to acknowledge that policy normalisation is coming."

And Simon Ballard at First Abu Dhabi Bank warned that more big gains in stocks are "going to create increasing levels of concern".

He added: "It's driven by, on one side, stimulus expectations from Mr Biden and also the expectation of that continued dovish rhetoric and more acceptance of early stages of inflation from the Fed."

However, OANDA's Jeffrey Halley said Treasury yields were still below pre-Covid levels and that the rise to one-year highs was "no bad thing" as it showed the economy was improving.

Investors are keeping tabs on China-US relations after Biden called on European allies to stand up to political and economic challenges from Beijing.

On currency markets, the pound held gains above $1.40 - its highest levels since April 2018 - as the British government's vaccine drive continued to progress well and as Prime Minister Boris Johnson laid out a plan for easing an economically painful virus lockdown.

Bitcoin eased to $57 150, having hit another record high of $58 350 over the weekend, and having passed $1 trillion in market capitalisation.

And oil prices bounced after being sold at the end of last week on profit-taking - having hit a 13-month high - and as US energy firms slowly restarted operations in Texas that had been hammered by a severe cold snap.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Asia Pacific Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Asia Pacific Star.

More InformationAsia

SectionTrump signals progress on India Trade, criticizes Japan stance

WASHINGTON, D.C.: President Donald Trump says the United States could soon reach a trade deal with India. He believes this deal would...

Dalai Lama to address Buddhist conference, reveal succession plan

DHARAMSHALA, India: The Dalai Lama is set to address a significant three-day conference of Buddhist leaders this week, coinciding with...

UN Demands End to Myanmar Violence as Junta’s Election Plans Risk Further Instability

Nearly three months after a devastating earthquake struck Myanmar, the country remains trapped in a deepening crisis, compounded by...

BRICS calls for urgent UNSC reform, reiterate support for India, Brazil to play greater role in UN

Rio de Janeiro [Brazil], July 7 (ANI): Leaders of BRICS nations reiterated support for 'comprehensive reform' of the United Nations,...

Condemning terrorism should be our 'principle', not just 'convenience': PM Modi at BRICS summit

Rio de Janeiro [Brazil], July 6 (ANI): Prime Minister Narendra Modi, during the 17th BRICS Summit on Sunday, asserted that condemning...

Haryana to develop Asia's largest jungle safari in Aravalli Hills

New Delhi [India], July 6 (ANI): A grand jungle safari project coming up in the Aravalli Hills is going to redefine Haryana's identity....

Business

SectionUS debt limit raised, but spending bill fuels fiscal concerns

NEW YORK CITY, New York: With just weeks to spare before a potential government default, U.S. lawmakers passed a sweeping tax and spending...

Shein hit with 40 million euro fine in France over deceptive discounts

PARIS, France: Fast-fashion giant Shein has been fined 40 million euros by France's antitrust authority over deceptive discount practices...

Meta hires SSI CEO Gross as AI race intensifies among tech giants

PALO ALTO/TEL AVIV: The battle for top AI talent has claimed another high-profile casualty—this time at Safe Superintelligence (SSI),...

Engine defect prompts Nissan to recall over 443,000 vehicles

FRANKLIN, Tennessee: Hundreds of thousands of Nissan and Infiniti vehicles are being recalled across the United States due to a potential...

Microsoft trims jobs to manage soaring AI infrastructure costs

REDMOND, Washington: Microsoft is the latest tech giant to announce significant job cuts, as the financial strain of building next-generation...

Stocks worldwide struggle to make ground Friday with Wall Street closed

LONDON UK - U.S. stock markets were closed on Friday for Independence Day. Global Forex Markets Wrap Up Friday with Greeback Comeback...