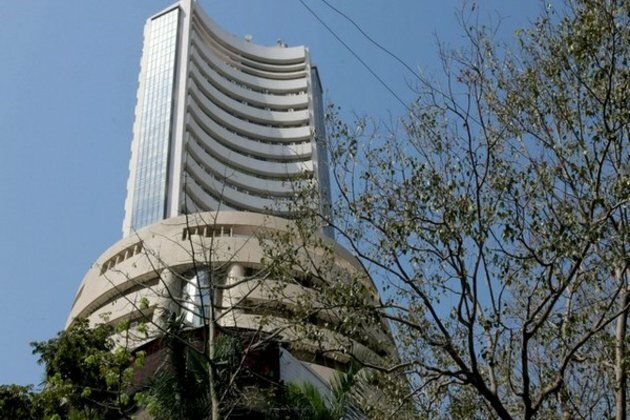

Sensex, Nifty snap 5-day rally; TCS, Infosys rise

ANI

14 Jan 2022, 16:57 GMT+10

Mumbai [India], January 14 (ANI): Snapping five days of rally, the Indian equities markets benchmark Sensex and Nifty closed in the red on Friday due to selling pressure in FMCG and some banking stocks.

The 30 stock SP Sensex of the Bombay Stock Exchange closed at 61,223.03 points, which is 12.27 points or 0.02 per cent down from its previous day's close at 61,235.30 points.

The Sensex closed in the red after a volatile session. The benchmark Sensex opened sharply down at 61,040.32 points and slumped to a low of 60,757.03 points.

The benchmark Sensex briefly soared in the positive touching a high of 61,324.59 points in the intra-day.

The broader Nifty 50 of the National Stock Exchange closed at 18,255.75 points, which is 0.01 per cent or 2.05 points down from its previous day's close at 18,257.80 points.

The Nifty touched a low of 18,119.65 points and high of 18,286.95 points in the intra-day.

There was selling pressure in banking stocks. Axis Bank slumped 2.54 per cent to Rs 721.60. IndusInd Bank fell 0.78 per cent to Rs 920.15; ICICI Bank dropped 0.67 per cent to Rs 818.90 and State Bank of India closed 0.60 per cent down at Rs 508.25.

Asian Paints 2.66 per cent down at Rs 3364.80; Hindustan Unilever 2.13 per cent down at Rs 2364.50; MahindraMahindra 1.61 per cent down at Rs 880.95; Wipro 1.55 per cent down at Rs 639.80; HDFC 1.52 per cent down at Rs 2713.55 and Bharti Airtel 1.48 per cent down at Rs 720.70 were among the major Sensex losers.

There was good buying support in IT stocks. TCS surged 1.84 per cent to Rs 3969.25. Infosys soared 1.64 per cent to Rs 1928.20. Tech Mahindra jumped 1.18 per cent to Rs 1739.25 and HCL Technologies rose 0.32 per cent to Rs 1337.55.

Other major Sensex gainers were: LT 1.32 per cent higher at Rs 2044.75; HDFC Bank 1.11 per cent higher at Rs 1545.25; UltraTech Cement 0.60 per cent higher at Rs 7655.25; Kotak Bank 0.54 per cent higher at Rs 1937.15 and NTPC 0.30 per cent higher at Rs 135.35. (ANI) Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Asia Pacific Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Asia Pacific Star.

More InformationAsia

SectionBeijing crowds cheer AI-powered robots over real soccer players

BEIJING, China: China's national soccer team may struggle to stir excitement, but its humanoid robots are drawing cheers — and not...

COVID-19 source still unknown, says WHO panel

]LONDON, U.K.: A World Health Organization (WHO) expert group investigating the origins of the COVID-19 pandemic released its final...

DeepSeek faces app store ban in Germany over data transfer fears

FRANKFURT, Germany: Germany has become the latest country to challenge Chinese AI firm DeepSeek over its data practices, as pressure...

Thailand-Cambodia tensions rise as border rules tighten

BANGKOK, Thailand: This week, Thailand implemented land border restrictions, including a ban on tourists traveling to Cambodia, as...

China boosting purchases of Russian metals Bloomberg

Aluminum, copper and nickel shipments have surged this year, according to trade data Beijing has increased purchases of Russian metals...

Jayant Khobragade appointed as next Ambassador of India to Spain

New Delhi [India], July 1 (ANI): The Ministry of External Affairs on Tuesday announced the appointment of Jayant Khobragade of the...

Business

SectionTech stocks slide, industrials surge on Wall Street

NEW YORK, New York - Global stock indices closed with divergent performances on Tuesday, as investors weighed corporate earnings, central...

Canada-US trade talks resume after Carney rescinds tech tax

TORONTO, Canada: Canadian Prime Minister Mark Carney announced late on June 29 that trade negotiations with the U.S. have recommenced...

Lululemon accuses Costco of selling knockoff apparel

Vancouver, Canada: A high-stakes legal showdown is brewing in the world of athleisure. Lululemon, the Canadian brand known for its...

Shell rejects claim of early merger talks with BP

LONDON, U.K.: British oil giant Shell has denied reports that it is in talks to acquire rival oil company BP. The Wall Street Journal...

Wall Street extends rally, Standard and Poor's 500 hits new high

NEW YORK, New York - U.S. stock markets closed firmly in positive territory to start the week Monday, with the S&P 500 and Dow Jones...

Canadian tax on US tech giants dropped after Trump fury

WASHINGTON, D.C.: On Friday, President Donald Trump announced that he was halting trade discussions with Canada due to its decision...